Dec 1, 2011 | Market Commentary

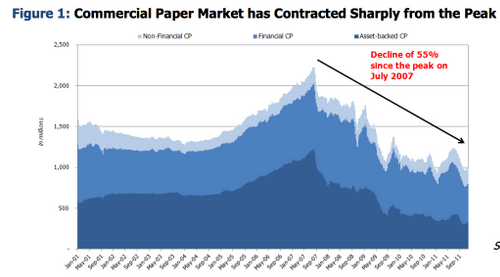

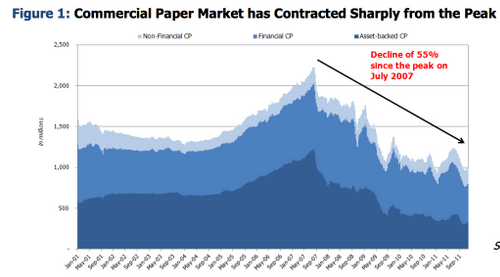

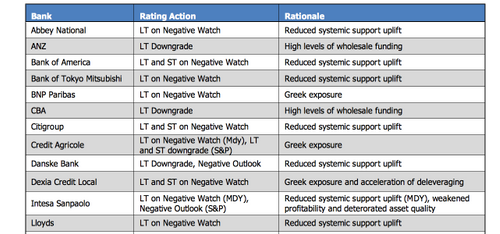

Money markets investors are operating in a dangerous environment full of overpriced, risky assets.

Jumping Over Dollars For Dimes

Nov 1, 2011 | Market Commentary

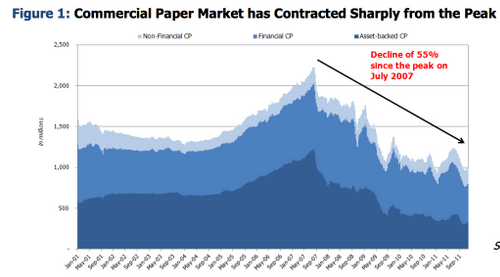

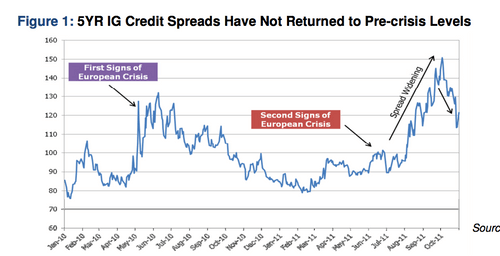

A defensive credit overweight will allow investors to navigate future volatility as the European debt crisis continues to unfold in an exceptionally low interest rate environment expected to last well into 2013.

Pushing on a String

Oct 1, 2011 | Market Commentary

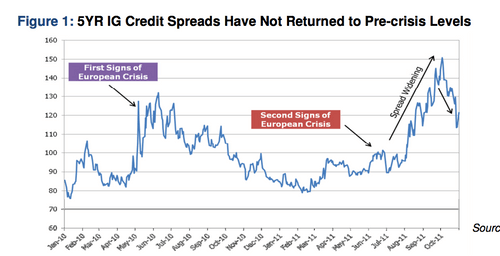

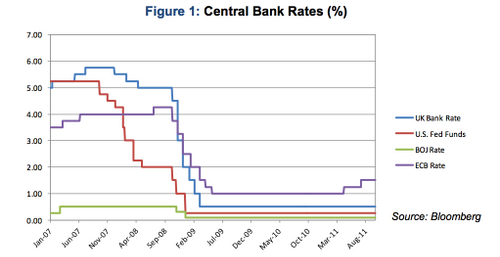

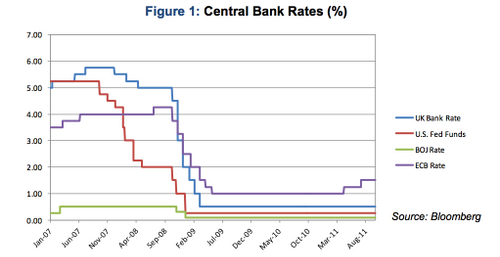

Consequently, as economic growth proves anemic, unemployment remains stubbornly high and inflation is contained within the Fed’s acceptable range, we examine what the Fed has accomplished and what it can do further.

A Renewed Case for Extension

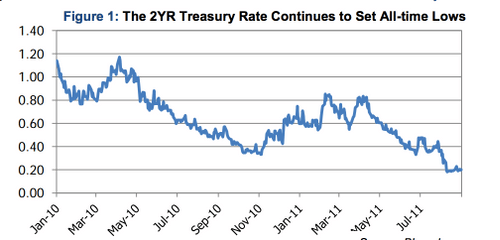

Sep 1, 2011 | Market Commentary

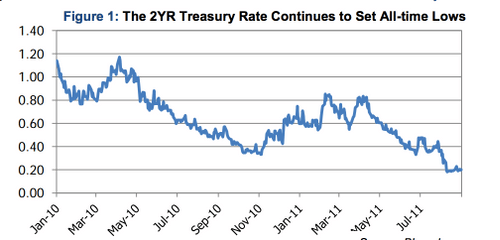

Our answer to this question, particularly, whether or not investors should extend the durations of their ultra-short liquidity pools, was rooted in our conviction that persistent economic weakness and uncertainty surrounding increased regulations warranted the FOMC...

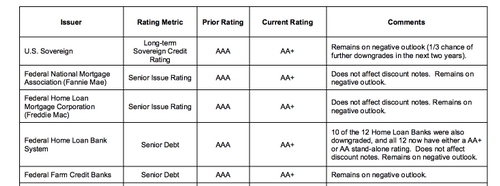

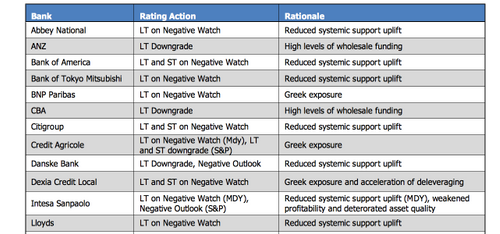

Deficits, Defaults, and Downgrades

Aug 1, 2011 | Market Commentary

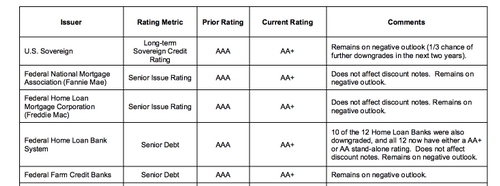

The markets were volatile in the days surrounding the events of the S&P downgrades, additional support measures in Europe, and continued weakness in the U.S. and global economy.

Cruel Summer

Jul 1, 2011 | Market Commentary

Rather than fighting against summer headwinds by remaining invested in risky credits (i.e., prime money funds, bank deposits and direct security holdings), we recommend investing further out the front-end curve in high-grade securities.